What's New

Check-out new articles we've added about payroll

December 11, 2025

We've added several articles in recent months, including information about Wage Garnishments, Gross vs. Net Pay, Understanding Payroll Costs, and What is the Federal Unemployment Tax (FUTA).

Payroll and Tax Consequences of the "One Big Beautiful Bill Act"

July 17, 2025

The One Big Beautiful Bill Act was signed into law on July 4, 2025, as Public Law 119-21, and goes into effect for the 2025 tax year. Below is guidance from the IRS describing how the new law will impact various aspects of payroll and taxes.

No Tax on Tips

- New deduction: Effective for 2025 through 2028, employees and self-employed individuals may deduct qualified tips received in occupations that are listed by the IRS as customarily and regularly receiving tips on or before December 31, 2024, and that are reported on a Form W-2, Form 1099, or other specified statement furnished to the individual or reported directly by the individual on Form 4137.

- “Qualified tips” are voluntary cash or charged tips received from customers or through tip sharing.

- Maximum annual deduction is $25,000; for self-employed, deduction may not exceed individual’s net income (without regard to this deduction) from the trade or business in which the tips were earned.

- Deduction phases out for taxpayers with modified adjusted gross income over $150,000 ($300,000 for joint filers).

- Taxpayer eligibility: Deduction is available for both itemizing and non-itemizing taxpayers.

- Self-employed individuals in a Specified Service Trade or Business (SSTB) under section 199A are not eligible. Employees whose employer is in an SSTB also are not eligible.

- Taxpayers must:

- include their Social Security Number on the return and

- file jointly if married, to claim the deduction.

- Reporting: Employers and other payors must file information returns with the IRS (or SSA) and furnish statements to taxpayers showing certain cash tips received and the occupation of the tip recipient.

- Guidance: By October 2, 2025, the IRS must publish a list of occupations that “customarily and regularly” received tips on or before December 31, 2024.

- The IRS will provide transition relief for tax year 2025 for taxpayers claiming the deduction and for employers and payors subject to the new reporting requirements.

No Tax on Car Loan Interest

- New deduction: Effective for 2025 through 2028, individuals may deduct interest paid on a loan used to purchase a qualified vehicle, provided the vehicle is purchased for personal use and meets other eligibility criteria. (Lease payments do not qualify.)

- Maximum annual deduction is $10,000.

- Deduction phases out for taxpayers with modified adjusted gross income over $100,000 ($200,000 for joint filers).

- Qualified interest: To qualify for the deduction, the interest must be paid on a loan that is:

- originated after December 31, 2024,

- used to purchase a vehicle, the original use of which starts with the taxpayer (used vehicles do not qualify),

- for a personal use vehicle (not for business or commercial use) and

- secured by a lien on the vehicle.

If a qualifying vehicle loan is later refinanced, interest paid on the refinanced amount is generally eligible for the deduction.

- Qualified vehicle: A qualified vehicle is a car, minivan, van, SUV, pick-up truck or motorcycle, with a gross vehicle weight rating of less than 14,000 pounds, and that has undergone final assembly in the United States.

- Taxpayer eligibility: Deduction is available for both itemizing and non-itemizing taxpayers.

- The taxpayer must include the Vehicle Identification Number (VIN) of the qualified vehicle on the tax return for any year in which the deduction is claimed.

- Reporting: Lenders or other recipients of qualified interest must file information returns with the IRS and furnish statements to taxpayers showing the total amount of interest received during the taxable year.

- Guidance: The IRS will provide transition relief for tax year 2025 for interest recipients subject to the new reporting requirements.

Deduction for Seniors

- New deduction: Effective for 2025 through 2028, individuals who are age 65 and older may claim an additional deduction of $6,000. This new deduction is in addition to the current additional standard deduction for seniors under existing law.

- The $6,000 senior deduction is per eligible individual (i.e., $12,000 total for a married couple where both spouses qualify).

- Deduction phases out for taxpayers with modified adjusted gross income over $75,000 ($150,000 for joint filers).

- Qualifying taxpayers: To qualify for the additional deduction, a taxpayer must attain age 65 on or before the last day of the taxable year.

- Taxpayer eligibility: Deduction is available for both itemizing and non-itemizing taxpayers.

- Taxpayers must:

- include their Social Security Number on the return and

- file jointly if married, to claim the deduction.

- Taxpayers must:

Deadline for CA Mandatory Company-Sponsored Retirement Plan

April 29, 2025

Approaching Deadline for CA Mandatory Company-Sponsored Retirement Plan

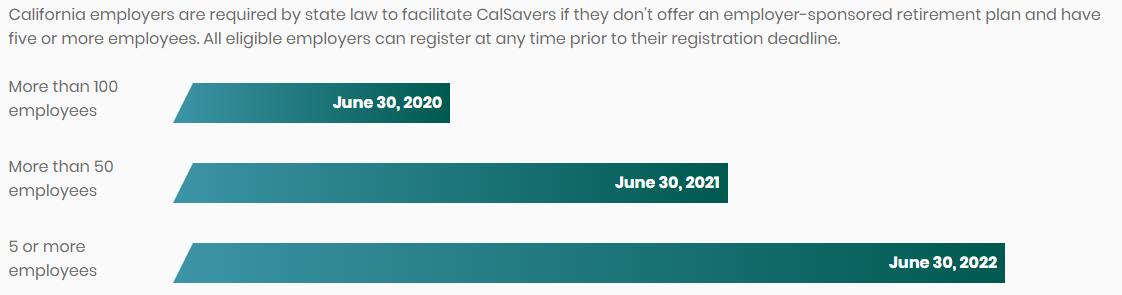

You may already be aware of the California law requiring businesses to provide a company-sponsored retirement plan program to their employees. Currently this law applies to businesses with 5 or more employees, as measured by the number of employees listed on your CA DE9c Quarterly Wage Payroll Tax Return.

You may not be aware that:

- This law will apply to ALL businesses (including those with 1 or more California employees) beginning January 1, 2026 (note -- owner employees are excluded).

- ALL businesses with 5 or more employees were to have registered for the "Calsavers" program by June 2022.

- Pay 'n Time has a technology partner to simplify how you meet your retirement program sponsorship requirements.

What is CalSavers? California’s retirement savings program

CalSavers, formerly known as Secure Choice, is the state of California’s retirement savings program for the millions of private-sector workers who don’t currently have a way to save for retirement at work. The program is designed to have no employer fees, no fiduciary liability, and fewer overall employer responsibilities. Legislation that created CalSavers stipulates employers must offer a retirement savings plan. If there’s no workplace retirement plan in place, businesses must offer their employees CalSavers, the state-operated retirement savings plan — or else face fines. The plan has a strong focus on small businesses, including employers with at least one employee.

BOI Filing - OFF Again - At Least for Now!

December 28, 2024

Beneficial Ownership (BOI) Filing with the Financial Crimes Enforcement Network (FinCEN) has been switched-back to a voluntary filing only, as the courts continue to debate whether the Corporate Transparency Act (CTA), which includes the BOI filing requirement is constitutional. This reverses the Fifth Circuit Court's decision earlier this week to block the lower court's injunction against the CTA.

Fifth Circuit Reinstates Corporate Transparency Act Compliance Requirements

December 27, 2024

According to the Wall Street Journal, on December 23, 2024, the Fifth Circuit Court of Appeals reversed a previous injunction that had blocked the enforcement of the Corporate Transparency Act (CTA). This decision reinstated the requirement for companies to file Beneficial Ownership Information (BOI) reports with the Financial Crimes Enforcement Network (FinCEN).

In response to this ruling, FinCEN announced extensions to the reporting deadlines to accommodate businesses:

- Companies created or registered before January 1, 2024: The deadline to file initial BOI reports is extended to January 13, 2025.

- Companies created or registered on or after September 4, 2024, with an original filing deadline between December 3 and December 23, 2024: The new deadline is January 13, 2025.

- Companies created or registered between December 3 and December 23, 2024: These companies have an additional 21 days from their original filing deadline to submit their initial BOI reports.

- Companies qualifying for disaster relief: Entities eligible for disaster relief may have extended deadlines beyond January 13, 2025, and should adhere to the later deadline.

- Companies created or registered on or after January 1, 2025: The original requirement remains; these companies must file their initial BOI reports within 30 days after receiving notice of their creation or registration.

These extensions aim to provide businesses with additional time to comply with the reinstated reporting requirements.

Secure 2.0: Sec. 109 Higher Catch-Up Contribution Limit to Apply at Ages 60-63

December 19, 2024

What are catch-up contributions?

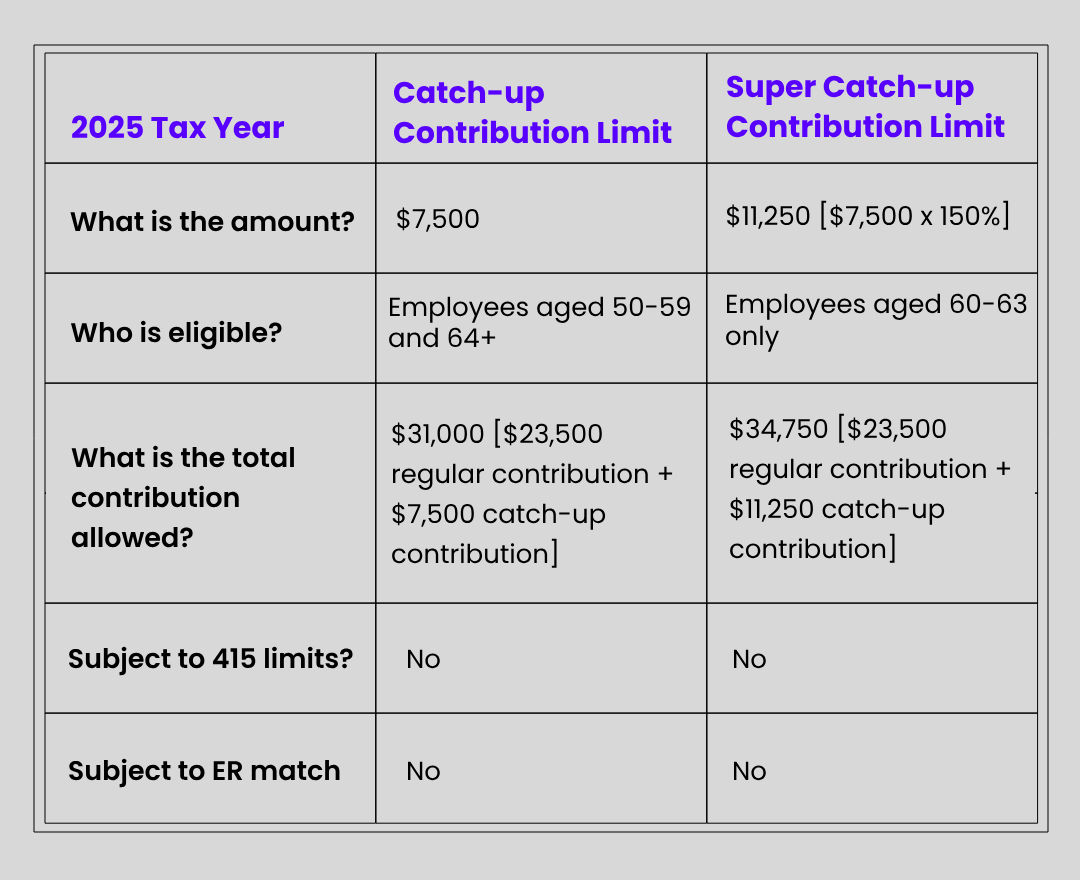

A "catch-up contribution" is an extra amount that employees age 50+ can contribute to their retirement accounts in addition to the standard 402(g) contribution limit. The IRS determines the annual limit of catch-up contributions each year. Catch-up contributions may be made into 401(k), 403(b), 457(b) government and other certain retirement plans.

What are higher catch-up contributions?

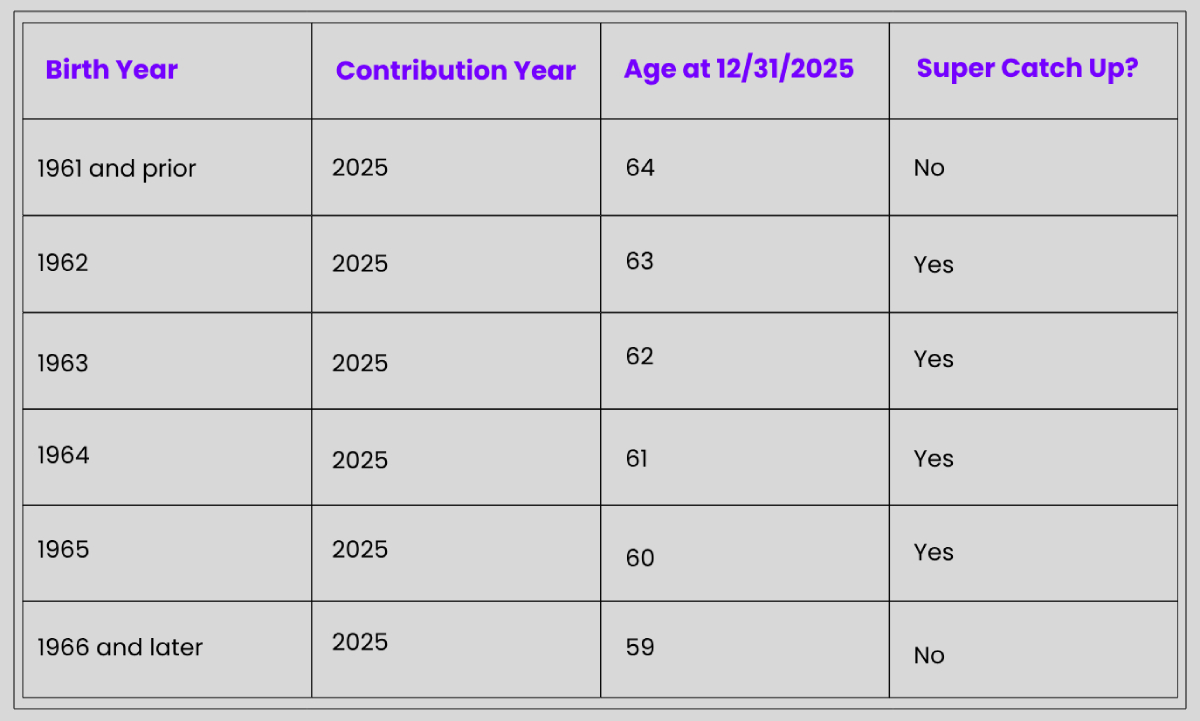

SECURE 2.0 Sec. 109 expanded catch-up contributions to allow a higher limit or what many plan administrators are calling "super" catch-up contributions beginning in 2025. Super catch-up contributions provide an opportunity for a group of employees ages 60, 61, 62, and 63 to maximize their retirement savings by increasing the annual limit of catch-up contributions. A super catch-up contribution is not a different or separate contribution. It simply allows a higher catch-up limit for those allowed.

The increased limit of a super catch-up contribution is the greater of $10,000 or 150% of the regular catch-up contribution for the calendar year. Based on the 2024 catch-up limit, 150% of $7,500 is greater than $10,000 so the super catch-up limit would be $11,250. The $10,000 will be adjusted annually beginning in 2026.

Note: Employees under age 50 cannot make catch-up or super catch-up contributions.

Sec. 109 of SECURE 2.0 did not mandate super catch-up contributions. This means that if a plan allows catch-up contributions, it does not have to allow super catch-up contributions. However, the consensus is that this provision is being generally supported. Most plan administrators are planning on offering an "opt-out" feature for those who do not wish to contribute super catch-up contributions. Specifics are still under consideration.

Pay 'n Time will be supporting super catch-up contributions starting in 2025. These contributions will be permitted for ALL employees ages 60-63 that elect catch-up contributions and are participating in a 401(k), 403(b), or 457(b) governmental plan. Super catch-up contributions are not applicable to 457(b) plans of tax-exempt employers.

Age Determination:

Catch-up and "Super" catch-up contributions will automatically be apaplied in our system based on birth dates.

All other catch-up eligible employees outside the 60-63 age group will continue to be allowed to contribute up to the regular catch-up limit only.

NEW MINIMUM WAGE RATES FOR MANY STATES AND LOCALES

June 18, 2024

Local and state minimum wage rates are increasing effective July 1, 2024 in many areas across the country. In California, cities such as Alameda, Berkely, Emeryville, Fremont, Los Angeles, Malibu, Milpitas, Pasadena, San Francisco, Santa Monica, and West Hollywood all have new rates. States increasing their rates include Nevada, Oregon, and District of Columbia. There are also numerous local minimum wage increases in other states. Pay 'n Time clients can access the HR Support Center for details on these increases.

The HR Support Center has received significant updates

The HR Support Center has received significant updates. Now known as the "Mineral HR Support Center" (we still shorten it to HRSC), there is new functionality that has been added. One great new feature allows companies to streamline and manage creation and maintenance of employee handbooks. There is also a Job Description Builder that has been added to create descriptions used for various positions within your companies. We highly recommend that you take advantage of this platform to help manage your HR practices and compliance.

For those of our clients who subscribe to the HRSC, you can access it directly from your login on the Pay 'n Time System. We usually set it up as a QuickLink on your Dashboard, but it can also be accessed through the menus here: Team > Learning > HR Support Center.

One thing you should definitely do on the site is to be sure that you setup your states in the admin portion of your account, and check to verify that you are receiving law alerts. This is the best way to be kept abreast of various new laws that may affect your company.

NEW MINIMUM WAGE RATES FOR MANY STATES AND LOCALES

Local and state minimum wage rates are increasing effective July 1, 2023 in many areas across the country. In California, cities such as Alameda, Berkely, Emeryville, Fremont, Los Angeles, Malibu, Milpitas, Pasadena, San Francisco, Santa Monica, and West Hollywood all have new rates. States increasing their rates include Nevada, Oregon, and District of Columbia. There are also numerous local minimum wage increases in other states. Pay 'n Time clients can access the HR Support Center for details on these increases.

California Mandatory Retirement Plan Program Expanded to all employers with one employee

California Senate Bill 1126, which was signed into law effective January 1, 2023, requires all California employers who have even a single non-owner employee to offer a company-sponsored retirement plan for all of their employees. This expands the existing law, which already required employers with at least 5 employees (as measured by the number of employees on their DE9c payroll tax return) to offer a company-sponsored retirement plan. Employers have until 12-31-2025 to put their retirement plan in place. There is currently no requirement for employers to make matching or other non-wage contributions to these plans.

CALIFORNIA TO REQUIRE ALL EMPLOYERS WITH 5 OR MORE EMPLOYEES TO PROVIDE MANDATORY SEXUAL HARASSMENT TRAINING

Updated June 4, 2020: The California Department of Fair Employment and Housing (DFEH) has finally released its free, online, nonsupervisory sexual harassment prevention training courses. The training courses are available here.

Update: California extended the deadline by which employers must comply with the new harassment prevention training requirements from January 1, 2020, to January 1, 2021. Non-supervisory employees must be trained within 6 months of hire.

Governor Jerry Brown recently signed SB-1343, a new California Law which requires all California Employers with 5 or more employees to provide at least one hour of sexual harassment training to all non-supervisory employees, and at least two hours for supervisory employees, by January 1, 2020, and once every two years thereafter. The law requires that the Department of Fair Employment and Housing create free online training to be available on their website.

What does this mean for CA Employers? Put this one down as a calendar reminder. Probably by sometime in the 3rd quarter of 2019, there should be training courses available on the DoFE&H website for your employees to participate in.

NEW California Mandatory Retirement Savings Program - CalSavers

Update - February 2020: Mandated participation in this new program begins this summer!

https://employer.calsavers.com/home/employers/program-details.html

September 30, 2016. Yesterday, a new California Law was signed that requires all employers with 5 or more employees to offer state-sponsored retirement plan. It will likely be at least several months before the program goes into effect, after which employers will have 3 months (for employers with 100 or more employees), six months (for employers with 50 or more employees), or 9 months (for all other employers) to comply.

The main tenants of the legislation are:

- Employees are required to participate with a 3% contribution unless they explicitly opt out of the program.

- If an employee opts out, s/he must be re-enrolled during an open enrollment that takes place at least every two years, unless the employee again explicitly opts out.

- Employers will need to make payroll deductions and submit them to the management agency for this new trust.

- There is no requirement for employers to make contributions in addition to employee contributions. However, employers may make such contributions on a voluntary basis.

Stay tuned for more information!

California is likely to be cracking down on inappropriate use of independent contractors

Update: In September, Governor Brown signed AB5. The new law codifies the Supreme Court Decision referenced below, and clarifies and expands it's use beyond California's Wage Orders.

The California Supreme Court has adopted a new, tougher legal standard for determining whether a worker is an independent contractor or an employee. The new test, called the ABC Test, is an all-or-nothing test. To properly classify a worker as an independent contractor, the employer must be able to satisfy all three parts of the test.

The ABC Test

A worker may be classified as an independent contractor if:

A. The worker is free from the control and direction of the hirer in connection with the performance of the work, both under the contract for the performance of such work and in fact;

B. The worker performs work that is outside the usual course of the hiring entity's business; and

C. The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

What does this mean to business owners?

If you have workers that you are paying as independent contractors, you should definitely spend some time evaluating whether each one meets all three elements of the ABC test. It is likely that the California tax agencies will be conducting more investigations of payments to, independent contractors, and cracking down on inappropriate independent contractor worker classifications.

This new law is effective immediately, so best to take action now!

For more information, please visit our HR Support Center.

CALIFORNIA COURT EXPANDS REPORTING TIME PAY TO INCLUDE CALL-INS

A California court of appeals ruling creates a new interpretation of reporting time pay requirements. Non-exempt employees who are required to call in to see if they must report for a scheduled on-call shift that day, and are not asked to work, are now entitled to reporting time pay, along with employees who physically show up at the workplace and are sent home for lack of work. Employers should update this policy during their next handbook review and ensure that all managers and others involved in timekeeping are made aware of the change in the meantime.

2019 California Minimum Wage and Exempt Employee Minimum Salary Increase

2019 brings a wide assortment of new minimum wage rates across the country, and, in particular, to California and many of its cities like San Jose that have local minimum wage rate laws. Please refer to the HR Support Center for detailed rates. Commensurate with these rate changes, beginning January 1, 2019, the minimum salary for exempt employees of employers with 26 or more employees in CA will increase to $49,920 per year. For employers with 25 or fewer employees, it will increase to $45,760 per year.

New Federal Tax Table and W4 for 2018

The IRS just released new tax tables which incorporate the congressional tax law that was passed at the end of December. Our developers are rushing to embed the new tables into our tax calculations as quickly as possible. Please bare with them, as they want to ensure they get it perfect for your employees!

Also note that the IRS is working on the 2018 W4 and has announced it should have one some time in February.

California Minimum Wage and Exempt Employee Minimum Salary Increase

2018 brings a wide assortment of new minimum wage rates across the country, and, in particular, to California and many of its cities like San Jose that have local minimum wage rate laws. Please refer to the HR Support Center for detailed rates. Commensurate with these rate changes, beginning January 1, 2018, the minimum salary for exempt employees of employers with 26 or more employees in CA will increase to $45,760 per year. For employers with 25 or fewer employees, it will increase to $43,680 per year.

California Bans Salary History Inquiries

Beginning January 1, 2018, California employers will no longer be able to ask applicants about their current or previous salary or hourly rate of pay, whether on an employment application or during the interview process. Additionally, employers must provide an applicant with the pay scale for the position upon reasonable request.

If an employer is aware or becomes aware of an applicant's salary history, that information should not be used to determine the rate of pay offered, unless the information was volunteered by the applicant without any kind of prompting. In accordance with the California Equal Pay Act (which is already in effect), even if salary history is provided without prompting, it must not be the only basis for a disparity in pay between employees.

INTRODUCING NEW PAY 'N TIME TEAM MEMBERS

The Pay 'n Time team has recently grown with the addition of two new team members, Laila Solyst and Chandra Jacquez. Laila and Chandra add more than 20 years of combined experience in payroll, new employee processing, and related fields. As "Payroll Accountants", both will be responsible for assisting existing Pay 'n Time Clients with getting their employees paid, and helping new clients through the implementation and training processes.

FEDERAL JUDGE PUTS THE NEW FLSA LAW ON HOLD

November 22, 2016. A Federal judge has temporarily blocked the US Department of Labor's new federal overtime rule, which would have doubled the FLSA's salary threshold for exemption from overtime pay to more than $47,000 per year.

NEW MINIMUM SALARY LAW TAKES EFFECT DECEMBER 1, 2016.

The FLSA changes announced by the US Department of Labor take effect on December 1, 2016. The new salary threshold for certain employees to qualify as exempt from time tracking and overtime under the Fair Labor Standards Act's White Collar Exemptions will be $47,476 per year. Pay 'n Time clients should log into the HR Support Center for more details on this new law that will affect all US employers who pay any employees a salary.

NEW CALIFORNIA LAW

September 30, 2016. Yesterday, a new California Law was signed that requires all employers with 5 or more employees to offer state-sponsored retirement plan. It will likely be at least several months before the program goes into effect, after which employers will have 3 months (for employers with 100 or more employees), six months (for employers with 50 or more employees), or 9 months (for all other employers) to comply.

The main tenants of the legislation are:

- Employees are required to participate with a 3% contribution unless they explicitly opt out of the program.

- If an employee opts out, s/he must be re-enrolled during an open enrollment that takes place at least every two years, unless the employee again explicitly opts out.

- Employers will need to make payroll deductions and submit them to the management agency for this new trust.

- There is no requirement for employers to make contributions in addition to employee contributions. However, employers may make such contributions on a voluntary basis.

Stay tuned for more information!

NEW MINIMUM SALARY LAW ANNOUNCED

May 18, 2016 - The US Department of Labor announced the new salary threshold for certain employees to qualify as exempt from time tracking and overtime under the Fair Labor Standards Act's White Collar Exemptions. Effective December 1, 2016, the new minimum salary level will be $47,476 per year. Pay 'n Time clients should log into the HR Support Center for more details on this new law that will affect all US employers who pay any employees a salary.

NEW CALIFORNIA MINIMUM WAGE LAW ENACTED

On April 4, California Governor Brown signed Senate Bill 3 into law. The new law increases the minimum wage to $15 per hour for all employers by January 1, 2023. Wage increases start at $10.50, increase to $11.00 the following year, add an additional $1 each year up to $15, and are annually indexed for inflation beginning in 2024. For employers with 26 or more employees, increases begin on January 1, 2017. For employers with 25 or fewer employees increases begin January 1, 2018. The minimum salary level for salaried employees exempt from overtime and other wage and hour rules remains at no less than two times the state minimum wage for full-time employment. Local statutes with higher minimum wage requirements may override the state law.

California Certified Payroll Online Submission Requirement Temporarily Put On Hold

DIR's Public Works Newsline 2016-04 announced the eCPR system is temporarily on hold until the system is upgraded to allow contractors and subcontractors to more easily submit certified payroll reports (CPRs) to DIR's system. Please check the DoIR web site for updates on when the requirement will be put back in place.

California introduces new Electronic Certified Payroll requirements

Beginning January 1, 2016, California contractors and subcontractors on all public works projects will need to upload certified payroll reports to the Department of Industrial Relations. Pay 'n Time's system can produce the export you will need to upload. We can even to the upload the report for you if you want. Click Here for more detail.

Local California Minimum Wage Ordinances May Affect Your Payroll

Several California cities have added new local minimum wage ordinances. These wage ordinances require businesses operating in these cities to pay their non-exempt workers a minimum wage that is higher than California's state minimum wage. Many of these cities are in the Bay Area. Pay 'n Time clients can view the most current minimum wages on the HR Support Center.

ATTENTION ALL CALIFORNIA EMPLOYERS

January 1st, 2015 a new Sick Leave bill went into effect.

Beginning July 1, employers will be required to grant at least one hour of paid sick leave to employees for each 30 hours they work. Employers may limit sick leave used in one year to 24 hours or three days. Sick time must be recorded on pay statements.