Articles

Understanding Payroll Expenses and the True Cost of Having Employees

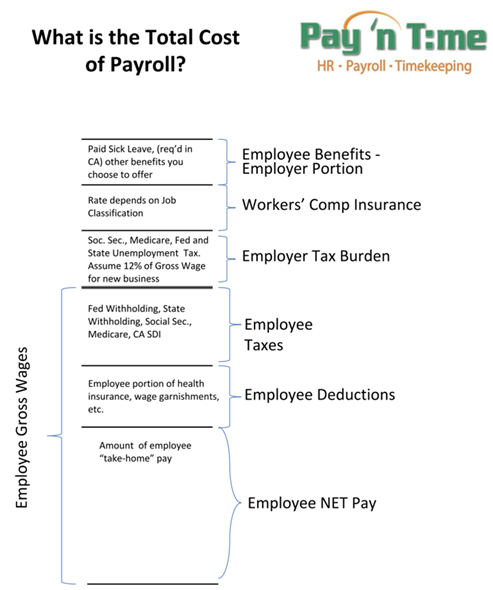

Hiring employees is one of the biggest steps a business can take toward growth — but it also brings significant financial responsibilities. Beyond wages, the total cost of employing someone includes taxes, benefits, insurance, and other obligations that can add 20%–50% (or more) to base pay. Understanding each component of payroll expenses is essential for accurate budgeting and compliance. The following chart is useful in providing a visual image for thinking about employer payroll costs.

Gross Pay vs. Net Pay

At the core of payroll accounting is the distinction between gross pay and net pay:

- Gross pay is the total amount an employee earns before any deductions. This includes hourly wages or salary, bonuses, overtime, and commissions.

- Net pay, often called “take-home pay,” is what remains after deductions such as income tax, Social Security, Medicare, and benefits contributions.

Employers are responsible for calculating and withholding these deductions accurately and remitting them to the appropriate tax authorities. Mistakes can lead to costly penalties and erode employee trust, which is the main reason businesses sign-up for payroll services.

Employer Payroll Taxes and the Tax Burden

Employers don’t just withhold taxes from employee paychecks — they also owe their own share of payroll taxes. In the U.S., these typically include:

- Social Security tax: 6.2% of an employee’s wages (up to the annual wage base limit)

- Medicare tax: 1.45% of all wages, with an additional 0.9% withheld from employees earning over $200,000 (the employer does not match the additional 0.9%)

- Federal and state unemployment taxes (FUTA and SUTA): These vary by state but can add several hundred dollars per employee annually. In California, for example, new businesses pay 3.5% of employee gross wages for State Unemployment Tax (SUTA) and the CA Education and Training Tax (ETT). After three years of operating a business with employees, the rate changes each year based on a complex formula which incorporates the amounts of unemployment benefit payments made by the tax agency to your former/terminated employees, and can range from 1.5% to 6.2%

When combined, these taxes represent a significant part of the employer’s overall cost structure. Employers must also file regular payroll tax reports and maintain compliance with federal and state agencies.

Employee Benefits: Beyond the Paycheck

Employee benefits enhance job satisfaction and retention but come at a cost to the employer. Common benefits include:

- Health insurance: Often one of the largest non-wage expenses. Employers typically pay a major share of the premiums — anywhere from 50% to 80% — for medical, dental, and vision coverage.

- Retirement plans: Many companies offer 401(k) or similar plans, sometimes with employer matching contributions.

- Paid time off (PTO): Vacation, holidays, and sick leave all represent paid non-working days that must be factored into total compensation. Some of these are optional benefits, but paid sick leave has become mandatory in many states.

- Bonuses and profit-sharing: These can create significant performance incentives, but must be included in payroll and tax calculations.

The cost of benefits can add 25–40% to base payroll costs, depending on the size of the company and the generosity of the package.

Workers’ Compensation Insurance

Nearly every U.S. state requires workers’ compensation insurance, which covers medical expenses and lost wages for employees injured on the job. Premiums vary based on industry risk, payroll size, and claims history. For example, construction companies may pay significantly higher rates than office-based employers. This coverage protects both the employee and employer from financial loss due to workplace accidents.

Other Payroll-Related Costs

In addition to wages, taxes, and benefits, employers often face other expenses tied to managing staff, such as:

- Payroll processing software or services - Businesses may use third-party payroll providers to handle calculations, tax filings, and compliance — typically at a monthly or per-employee cost.

- Training and onboarding - New employees require orientation, training, and sometimes certifications — all of which consume time and resources.

- Compliance and recordkeeping - Labor laws require accurate tracking of hours worked, pay rates, and employee classifications. Noncompliance can result in penalties or lawsuits.

- Turnover costs - Recruiting, interviewing, and replacing employees adds hidden costs that many businesses overlook. Retention strategies can reduce these expenses over time.

Estimating the True Cost of an Employee

As a rule of thumb, a business can expect to spend 1.25 to 1.5 times an employee’s gross salary on total employment costs. For instance, an employee earning $60,000 annually may actually cost the company $75,000–$90,000 once taxes, benefits, insurance, and overhead are included.

Understanding these expenses helps business owners:

- Budget accurately for payroll

- Set competitive but sustainable compensation packages

- Avoid compliance pitfalls

- Plan long-term staffing and growth strategies

Conclusion

Payroll expenses are far more than just wages — they represent a comprehensive investment in your workforce. By accounting for taxes, benefits, insurance, and other associated costs, employers can make informed financial decisions and create fair, compliant, and competitive compensation structures. Clear understanding of these obligations not only supports financial stability but also strengthens employee satisfaction and retention.